Recent data validates the persisting issue of unaffordability, as the majority of housing in the UK has become exclusive to the affluent segment of the population.

It is not surprising to low-income households that purchasing any property in the UK has become a privilege reserved for the wealthy.

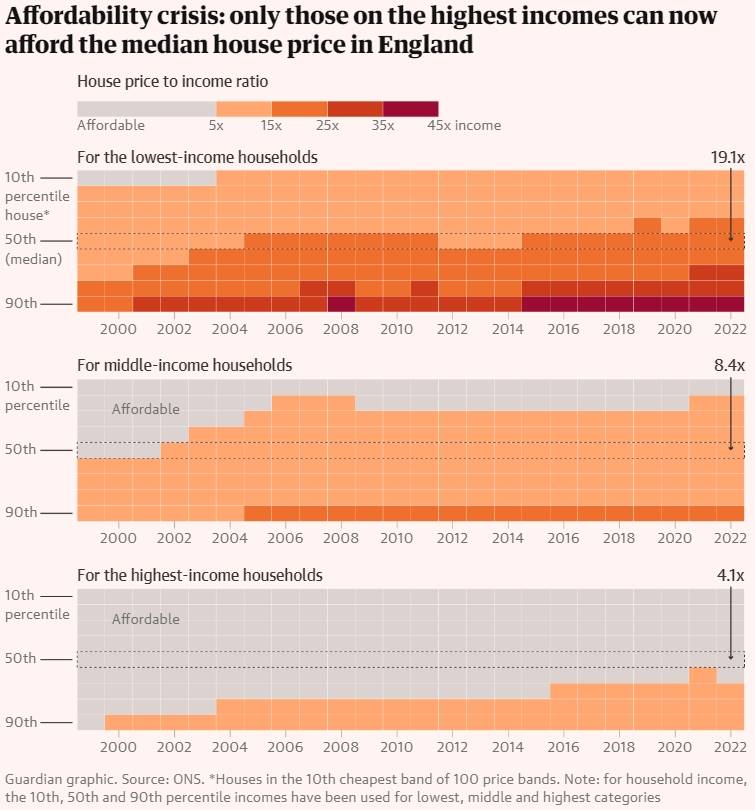

Official data reveals that the middle-income households in England are facing mounting pressure, as only the most affordable 10% of houses (limited to five times a household’s income, according to the Office for National Statistics) are within their reach.

Recent data confirms a long-standing trend that has been developing for years. In the past two decades, a household with median income in England has been unable to afford a mid-range-priced house. However, apart from the period surrounding the 2008 housing bubble when prices surged, the median household could still manage to purchase a house within the most affordable 20% of the market.

The situation took a significant turn in 2021, as the middle-income households could now only afford the most affordable 10% of properties. The recently released 2022 data further confirms this change.

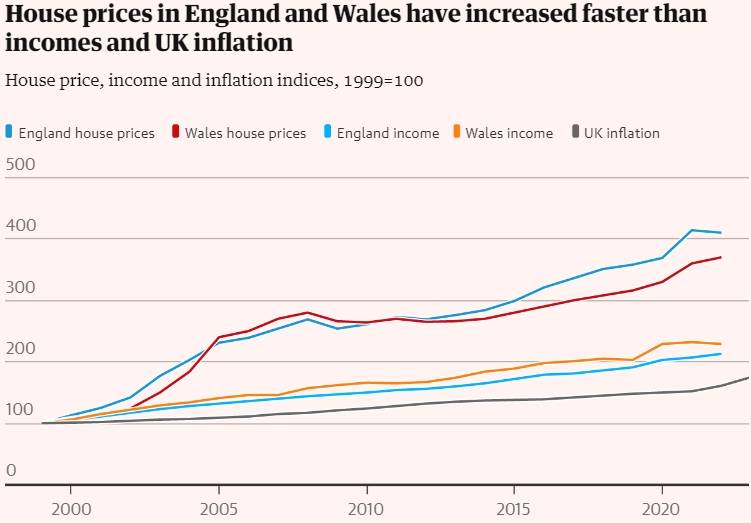

Looking back to 1999, the median house price in England was 4.4 times the median income, as reported by the ONS. The median value represents the middle point in a distribution of numbers, ensuring that extreme house prices or incomes do not distort the average.

During the late 2000s, there was a significant boom in house prices. Although house prices eventually recovered after the subsequent crash, wages failed to keep pace, especially in the aftermath of the global financial crisis. The most recent figures for 2022 reveal that the house price to income ratio had nearly doubled to 8.4 times income, reflecting the widening gap between house prices and earnings.

The national figures only provide part of the picture as Southern England has consistently been the least affordable region to buy a property in. Last year, only the top 10% of households could afford the average home in the south-east. The situation is even more dire in London, where the average home is now considered unaffordable even for households within the top 10% income bracket according to official measures.

In recent years, the issue of unaffordable house prices has extended beyond the traditionally expensive south. Although the north-east remains the most affordable region to buy a house in England, the median house now costs 5.3 times the median household income in that area. While unaffordability has long been a concern in England, it has become a more recent trend in other parts of the UK.

The affordability of a median-price home in Wales became a challenge for the typical household in 2004, with the ratio reaching 6.4 times the median household income in 2022. Similarly, in Scotland, the ability to afford a mid-priced home was lost for the equivalent household in 2006, with the ratio reaching 5.3 times income in 2022. Northern Ireland experienced a brief period of affordability, but in 2017, it became unaffordable again, reaching a ratio of 5.1 times income last year.

These statistics have significant implications for those aspiring to enter the property market. Normally, mortgage lenders follow a ratio of 4-4.5 times an individual’s salary to determine borrowing capacity. However, with the recent increase in interest rates, obtaining a mortgage has become unattainable for many younger individuals. To accommodate the soaring house prices, banks have had to extend their salary multiples. For instance, last year, Nationwide permitted first-time buyers to borrow up to 5.5 times their income if they put down a 5% deposit. Additionally, some mortgage products have been offered with ratios as high as seven times income in recent years.

As a consequence, it’s hardly surprising that the number of adults residing in their family homes in England and Wales has surged by 700,000 since 2011. Approximately 30% of 25- to 29-year-olds are now living with their parents due to these circumstances. This trend has resulted in a higher proportion of individuals who do move out having to allocate a significant portion of their income to landlords, as the number of households renting has more than doubled since 2001. Unfortunately, in many regions of the country, renting is also becoming an increasingly unaffordable option.